Table of Contents

- Introduction

- What is a Home Equity Line of Credit?

- How Does HELOC Work?

- Imagine Your Home is a Piggy Bank 🐖💰

- Why Do People Get HELOCs?

- When Life Throws You a Curveball 🤷♂️

- How to Apply for a HELOC

- Step-by-Step Guide 📝

- HELOC vs. Other Loans

- Comparing Apples and Oranges 🍎🍊

- Home Equity Lines of Credit Interest Rates

- The Price of Borrowing Money 💲

- Making Payments on Your Home Equity Lines of Credit

- Paying Back Your Piggy Bank 🐖💵

- Pros of Home Equity Lines of Credit

- The Good Stuff 😊👍

- Cons of Home Equity Lines of Credit

- The Not-So-Good Stuff 😔👎

- Home Equity Lines of Credit Tips and Tricks

- Navigating the Piggy Bank Maze 🧐🗺️

- Home Equity Lines of Credit Mistakes to Avoid

- Don’t Break the Piggy Bank! 🚫🐖

- Is a Home Equity Lines of Credit Right for You?

- Finding Your Financial Fit 🤔🔍

- Summary

- Wrapping Up Our Piggy Bank Adventure 🎁🏡

- Call to Action

- Take Action Today! 🚀📢

- FAQs

- Your HELOC Questions Answered 🙋♀️🙋♂️

Introduction

Howdy, little mate! 🌟 Have you known about something many refer to as a “Home Equity Line of Credit,” or HELOC for short? It could seem like a major, grown-up word, however, I vow to clarify it for you in the most straightforward manner conceivable. Thus, get your number one toy, and how about we plunge into the supernatural universe of HELOCs?

What is a Home Equity Line of Credit?

Okay, imagine your home is like a gigantic piggy bank 🐖💰. You know how you put your shiny coins in your piggy bank to save them? Well, grown-ups have a piggy bank too, but it’s called a “home.” And guess what? Inside that home, there’s something special called “equity.”

Esteem looks like the fortune you get when you’ve paid for a piece of your home. It’s the qualification between how much your home is worth and the sum you owe on it. Presently, a Home Equity Line of Credit (HELOC) resembles an enchanted spell that allows you to get cash from your home’s money box, however just when you want it. Isn’t excessively cool?

How Do Home Equity Lines of Credit Work?

Imagine this: you have a magic card 💳. At the point when you want cash, you can utilize this card to take out a portion of the fortune from your home’s stash. However, recollect, you need to vow to return the fortune sometime in the future, very much as you do with your stash.

So, if you want to fix your house, go to college, or do anything important, this magic card can help you get the money. But don’t forget, you have to be responsible and pay it back, just like a big kid!

Why Do People Get Home Equity Lines of Credits?

You know how sometimes life throws you a curveball, like when you want that toy, but you don’t have enough money? Grown-ups have curveballs too, like surprise medical bills or sudden home repairs. HELOCs are like superheroes that come to the rescue when grown-ups need money for these unexpected things.

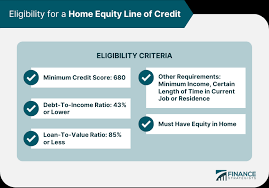

How to Apply for a Home Equity Lines of Credit

Getting a HELOC is like going on an adventure. You need to talk to a bank or a friendly financial wizard. They’ll ask you a few inquiries and make sure you’re. Assuming they think you are, they’ll give you that magic card we discussed before!

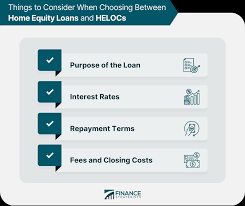

Home Equity Lines of Credit vs. Other Loans

Do you know how there are different types of candies 🍎🍊? Well, there are also different types of loans. HELOC is one kind, and it’s special because you only use it when you need it. Other loans are like candies you eat all at once, but HELOC is like having a candy jar that you can dip into when you want.

Home Equity Lines of Credit Interest Rates

When you borrow money, you usually have to give a little extra back as a thank-you to the bank. That extra is called “interest.” It’s like sharing some of your candies with your friend for letting you borrow their toys. The interest rate tells you how much extra you have to give.

Making Payments on Your Home Equity Lines of Credit

Just like you save your allowance, grown-ups need to save too! When you use your magic card to borrow money from your home’s piggy bank, you have to start saving and giving the treasure back. It’s important to do this on time, so the piggy bank stays happy!

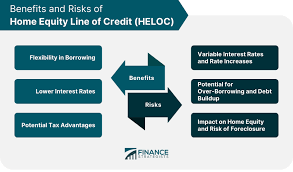

Pros of Home Equity Lines of Credit

HELOCs have some super cool benefits, like being able to borrow money when you need it and using your home’s treasure chest for important things like fixing your house or going on a vacation. It’s like having a secret stash of candies for emergencies!

Cons of Home Equity Lines of Credit

In any case, pause, there are likewise some not-really fun things about HELOCs. If you don’t take care of the cash on time, the stash could fly off the handle, and you could lose your home. That is the reason it means quite a bit to be mindful and not take out an excess of cash.

Home Equity Lines of Credit Tips and Tricks

Exploring the universe of HELOCs can be a piece precarious. However, relax, I have a few hints and deceives to help you en route. It resembles having a fortune map 🗺️ to ensure you don’t lose all sense of direction in the stash labyrinth!

Home Equity Lines of Credit Mistakes to Avoid

Just like you shouldn’t shake your piggy bank too hard, there are some things you should avoid when it comes to HELOCs. We’ll talk about these mistakes so you can keep your home’s treasure safe.

Is a Home Equity Lines of Credit Right for You?

Not all grown-ups need a HELOC. It relies upon what they maintain that should do and on the off chance that they can be answerable for it. We’ll assist you with sorting out whether or not a HELOC is the ideal decision for you when you grow up.

Summary

Wow, we’ve had quite an adventure exploring the magical world of HELOCs, haven’t we?

All this and more are unveiled in our blog post. http://www.saddysyard.com